The start of a new year often comes with resolutions, ambitions, and goals to make the year better than the previous one.

If you are considering venturing into the POS business, you are on the right track! Despite the widespread adoption of digital banking, the demand for cash and payment convenience continues to grow, especially in regions where banking infrastructure is inadequate. This article will provide you with detailed insights into starting and growing a successful POS business while highlighting tools like EasyBalance that can make your journey seamless.

Why the POS Business Remains Lucrative

The POS business is far from being saturated in Nigeria and across many African regions. While more banks and fintech companies are providing digital solutions, cash remains a necessity for daily transactions, particularly in rural and semi-urban areas where access to banking facilities is limited. Here are the key reasons why the POS business is profitable:

- High Demand: People always need cash for small-scale transactions. Banks and ATMs alone cannot meet the growing demand for financial services.

- Flexibility: Your profitability will largely depend on your location and how well you structure your services. Areas with high foot traffic, markets, or underserved banking infrastructure can yield significant profits.

- Scalability: Once you establish a profitable base, you can easily scale by opening more outlets or offering value-added services like bill payments, airtime recharge, and money transfers.

What You Need to Know Before Starting a POS Business

Starting a POS business goes beyond getting a terminal and finding a location. Here are the key things you must consider to lay a strong foundation:

1. Understand the Business Modalities

- Learn how the POS business works, from cash withdrawal and deposit processes to managing commissions and fees.

- Research operational procedures and payment settlements to avoid unnecessary setbacks.

2. Choose the Right Location

- Profitability in the POS business is location-sensitive. Find areas with high cash demand, such as markets, busy streets, or places with limited access to banks or ATMs.

- Avoid areas already saturated with POS agents unless you have a unique value proposition.

3. Secure Trusted Staff

- If you plan to operate multiple POS outlets, hiring staff is inevitable. However, staff theft and dishonesty are common risks in this business.

- Build a risk management strategy, such as conducting background checks and using digital tools like EasyBalance to track staff activities and transactions centrally.

4. Gain Technical Knowledge

- Familiarize yourself with the operational terms and settings of POS terminals. Learn how to troubleshoot minor issues to avoid downtime.

- Understanding the technical side of your business reduces your reliance on third-party technicians and enhances your efficiency.

5. Risk Awareness

- Be mindful of the risks of fraud, theft, and poor cash management. A robust risk management plan will protect your business.

Funding the Business

Every business needs funding, and the POS business is no exception. While the initial setup cost may seem manageable, you need cash reserves to handle daily operations effectively. Here’s how to fund your business and build cash flow relationships:

- Leverage Personal Savings: Many entrepreneurs start their POS business with personal savings to cover startup costs and maintain liquidity for daily transactions.

- Create Cash Flow Partnerships: Build relationships with businesses that deal with large cash inflows, such as supermarkets, gas stations, and wholesale traders. These partnerships can help you source cash reliably while reducing trips to the bank for withdrawals.

Scalability and Expansion

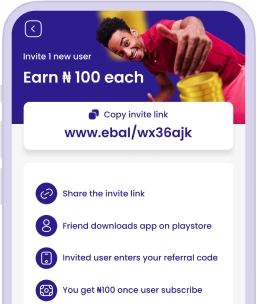

As your POS business grows, scaling up becomes a viable option. However, without the right tools, managing multiple outlets and increased transactions can become chaotic. This is where EasyBalance comes into play:

- Centralized Business Management:

EasyBalance enables you to track and manage all your POS outlets from a single dashboard. Whether you have one location or ten, you can oversee every transaction, reconcile daily balances, and monitor staff performance seamlessly. - Data Analysis for Growth:

With EasyBalance, you can analyze your business performance using detailed reports on transactions, customer behavior, and profitability. These insights help you identify areas for improvement and expansion. - Automated Bookkeeping:

Manual bookkeeping is prone to errors and can be time-consuming. EasyBalance automates your records, ensuring accuracy and saving you time to focus on growing your business. - Offline Functionality:

Even in areas with poor internet connectivity, EasyBalance’s offline features ( in-development )allow you to continue operations uninterrupted, ensuring consistent service delivery to your customers.

Risk Management in the POS Business

The POS business, while lucrative, comes with its risks. Here’s how to manage them effectively:

- Fraud Prevention: Fraudulent activities, such as fake alerts or unauthorized transactions, are common in the industry. Train your staff to verify every transaction and keep detailed records.

- Theft Prevention: Staff dishonesty and theft can cripple your business. Use tools like EasyBalance to monitor transactions in real-time and reconcile cash balances daily.

- Insurance: Consider insuring your business against losses resulting from theft, fire, or equipment damage.

Your Blueprint for a Successful POS Business

To summarize, here’s your roadmap for starting and growing your POS business in 2025:

- Learn and Prepare: Understand how the business works, gain technical knowledge, and research your target location.

- Secure Funding: Use personal savings or partnerships to maintain cash flow and cover running costs.

- Choose the Right Tools: Invest in digital solutions like EasyBalance to manage your business efficiently.

- Focus on Customer Satisfaction: Build a reputation for reliability, fast service, and transparency. This will drive repeat customers and word-of-mouth referrals.

- Expand Strategically: Scale your business by adding outlets, diversifying services, and leveraging data insights from EasyBalance.

- Mitigate Risks: Implement fraud prevention strategies, hire trusted staff, and monitor activities closely using digital tools.

Final Thoughts

The POS business holds immense potential for profitability and growth, but success requires more than just owning a terminal. By taking a strategic approach, leveraging digital tools like EasyBalance, and mitigating risks effectively, you can build a thriving POS business that stands the test of time.

Make 2025 the year you turn your entrepreneurial dreams into reality. Start smart, grow wisely, and always prioritize customer satisfaction. With determination and the right tools, your POS business can become a cornerstone of financial convenience in your community!

#posbusiness #agencybanking #mobilebanking #posmoniepoint #startuppos #posstartups #sme #easybalance